The Federal government is paralyzed by ideology, bloated with corruption, and increasingly unable or unwilling to deliver basic functions. The collapse of federal coherence has forced states to become sovereign in everything but currency. That’s a longer conversation. But for states now forced to confront real-world crises dumped at their doorstep by federal abdication, it means one thing: they must learn to govern without the power of the printing press.

In practical terms, that makes US states more like EU nations than sovereign actors. They cannot mint currency. They cannot run deficits without limit. And yet they are expected to deliver public services, build infrastructure, and shield their citizens from both corporate extraction and federal dysfunction. To do that, they must develop internal resilience – economic, digital, and institutional.

It is in a state’s interest to keep as much capital circulating within its borders as possible, where it can compound and accrete for the benefit of its residents. It is in its interest to accelerate the economic cycle of key industries, from innovation to industrialization to utility, so that vital services become cheaper, more reliable, and less dependent on outside actors. And it is in its interest to collect revenue in ways that are efficient, minimally disruptive, and strategically aligned with its long-term goals.

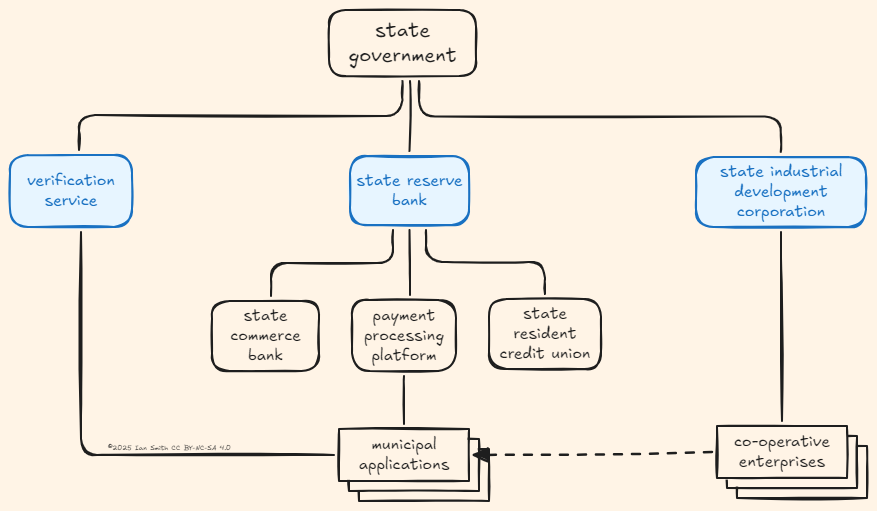

To achieve this, every state should take three foundational steps:

- First, create a verification service that provides a cryptographically secure, privacy-preserving way to confirm key civic facts: age, licensure, eligibility, registration. The building blocks of civil order.

- Second, charter a State Reserve Bank with access to the FedNow real-time payment network, giving the state financial sovereignty in a post-check, post-office-hours world.

- Third, establish a State Industrial Development Corporation that serves as a public-sector venture engine to incubate new enterprises, conduct strategic research, and build cooperative firms designed to maximize member well-being over shareholder value.

These aren’t just policy tools. They are instruments of memory, agency, and coordination, the minimal organs of a self-governing body. A verification service remembers what’s true. A reserve bank acts. A development corporation imagines and builds. Together, they constitute a viable operating system for a sovereign state in a failing empire.

Verification Service

Prove that you are who you say you are. That’s one of the oldest and most fundamental problems in society. Historically, we solved it with paper documents backed by the authority of the state. But when society moved online, identity stayed behind. The result: a digital world where lying about who you are is cheap, easy, and at the root of nearly every form of cybercrime.

The government has always needed to verify claims about your age, your eligibility, your licenses and registrations. Most of these boil down to a few simple yes-or-no questions: Are you over 18? Are you registered to vote? Are you licensed to drive or to practice medicine? Are you eligible for this benefit or that exemption?

Advances in cryptography and the design of information systems mean we can hand out digital identities (did) which allow for these kind of yes-or-no questions to be answered without collecting or sharing any other information using what are referred to as Verifiable Credentials (VC) and Zero-Knowledge Proofs (ZK).

Verifiable credentials are digital ID cards issued by trusted sources like governments, licensing boards, and medical authorities. They let you prove specific facts about yourself without showing everything else.

Zero-knowledge proofs go further: they let you prove something is true without revealing why it’s true. You can confirm you’re over 18 without sharing your birthday. You can show you have a valid fishing license without giving your name or address. It’s the cryptographic equivalent of saying yes, without opening your wallet.

Once you have a verifiable credential (VC), it can be used to generate a special kind of digital token that contains a pre-calculated zero-knowledge proof. That means the heavy math is done ahead of time, and the token is ready to show when needed. For example, your VC might say you’re over 18, and from that, your device can create a token that proves this fact without revealing anything else. When a website asks, you present the token and it verifies instantly, with no need to re-calculate or re-check your ID. This makes using zero-knowledge proofs fast, private, and practical for everyday things like age checks or license verification.

This is where the state comes in. It already issues credentials: licenses, registrations, RealIDs. By backing a public verification service, the state can let anyone from poll workers to bartenders, movie theaters to websites verify a specific claim instantly, securely, and without violating anyone’s privacy. The proof becomes the product. One yes, nothing more. No name, no address, no excess. Nothing but a cryptographic confirmation that something is true.

And that confirmation is, crucially, anonymous. We may need the state to lend us back some of the authority we’ve granted it in order to verify the claims we make. But we don’t need to cede more power in the process. Verification without cataloging. Authority without intrusion.

State Reserve Bank

We live in a financialized world where sovereignty is increasingly exercised not through laws or armies, but through credit, capital, and control over infrastructure. The federal government no longer guarantees alignment with local priorities. States are left to fend for themselves, especially when commercial incentives diverge from public needs.

A State Reserve Bank offers a structural response. It anchors state-level financial autonomy: a direct interface to the world of commercial finance, but one built to serve public rather than private aims. It can power payment rails, support local institutions, and provide essential services, which might otherwise be captured by extractive commercial intermediaries, directly to state agencies, counties, cities, and citizens.

From this foundation, states can build further. A Reserve Bank can provide access to FedNow, underwrite a State Commerce Bank, seed a State Resident’s Credit Union, and manage a digital payment processing platform for credit cards, ACH, and money transfers. These aren’t upgrades; they’re infrastructure. And investing in them means keeping more of the state’s dollars circulating, compounding, and working in the state for the people who live there.

State Industrial Development Corporation

With a State Reserve Bank in place, states gain the financial architecture to charter something new: the State Industrial Development Corporation, a public-sector R&D engine and civic laboratory whose mission is to design and deploy cooperative enterprises that maximize member well-being not shareholder value.

This isn’t just a funding body. It’s a producer. A builder. Part Bell Labs, part industrial policy architect, part civic venture studio. Its focus is on the kinds of value markets either distort, ignore, or destroy. It operates in three domains:

- The Well-Being Market: These are activities deeply desired for their social benefit, like education, healthcare, or environmental restoration, but which collapse under traditional profit models. Here, the goal is to create enterprises that protect what is good by refusing to extract from it.

- Digital Civil Infrastructure: These are the protocols and platforms that support government services, civic life, and public goods in the digital age. Identity systems, payment rails, communication layers; tools meant to serve and then disappear into the background of everyday life, like plumbing or power lines.

- Local Innovation and In-State Economic Engines: This is the experimental frontier. Startups, research collectives, mobile response units, city-level innovation finance offices. Projects designed not just to spark economic growth, but to reclaim capital otherwise siphoned away by extractive industries and remote shareholders.

The era of delegated competence is over. States can no longer afford to wait for coherence to return to Washington, nor to hope that commercial platforms will solve problems they were never designed to address. If a state wants to survive the coming decades with any measure of autonomy, equity, or dignity, it must build. Build memory. Build agency. Build infrastructure. These three institutions—the Verification Service, the Reserve Bank, and the Development Corporation—are not optional upgrades. They are preconditions for meaningful sovereignty in a world where no one is coming.